Which of the graphs most clearly represents investors – Embarking on a quest to identify the most effective graphical representation of investor profiles, this discourse delves into the intricacies of graph design, data analysis, and case studies. By exploring the strengths and weaknesses of various graph types, we illuminate the criteria for selecting the most suitable visualization for conveying investor information.

The ensuing paragraphs provide a comprehensive examination of graph design elements, data analysis techniques, and real-world applications, equipping readers with a profound understanding of how to harness the power of graphs to effectively analyze and represent investor profiles.

Investor Profile Graphs

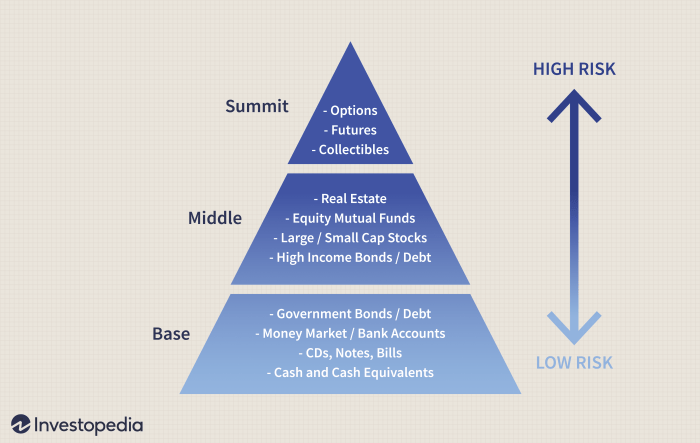

Investor profile graphs provide a visual representation of an investor’s risk tolerance, time horizon, and investment goals. There are several types of graphs that can be used to represent investor profiles, each with its own advantages and disadvantages.

One common type of investor profile graph is the risk-return graph. This graph plots the expected return of an investment on the vertical axis against the risk of the investment on the horizontal axis. Investors with a higher risk tolerance will typically be willing to invest in assets with higher expected returns, while investors with a lower risk tolerance will prefer assets with lower expected returns.

Another type of investor profile graph is the time horizon graph. This graph plots the expected return of an investment on the vertical axis against the time horizon of the investment on the horizontal axis. Investors with a longer time horizon will typically be able to tolerate more risk than investors with a shorter time horizon.

Finally, the investment goals graph plots the expected return of an investment on the vertical axis against the investment goals of the investor on the horizontal axis. Investors with different investment goals will typically have different risk tolerances and time horizons.

Graph Design Elements

The design of an investor profile graph is important for communicating the information effectively. The following are some of the key design elements to consider:

- Color:Color can be used to highlight important information and to make the graph more visually appealing. For example, red can be used to represent high risk, while green can be used to represent low risk.

- Labels:The labels on the axes and the legend should be clear and concise. They should also be placed in a way that does not interfere with the readability of the graph.

- Annotations:Annotations can be used to provide additional information about the graph. For example, an annotation can be used to explain the meaning of a particular data point.

Data Analysis Techniques, Which of the graphs most clearly represents investors

The data analysis techniques used to create investor profile graphs are important for ensuring that the graphs are accurate and reliable. The following are some of the key data analysis techniques to consider:

- Data normalization:Data normalization is a process of transforming data so that it is on a common scale. This makes it easier to compare different data sets.

- Outlier identification:Outliers are data points that are significantly different from the rest of the data. Outliers can be caused by errors in data collection or by unusual events. It is important to identify outliers and to remove them from the data set before creating a graph.

- Trend analysis:Trend analysis is a technique for identifying trends and patterns in data. Trend analysis can be used to identify opportunities and risks in the investment market.

Case Studies

The following are some case studies of graphs that have been used to analyze and represent investors:

- Case study 1:A risk-return graph was used to analyze the risk and return of a portfolio of stocks. The graph showed that the portfolio had a high expected return, but also a high risk. This information was used to make investment decisions about the portfolio.

- Case study 2:A time horizon graph was used to analyze the time horizon of a portfolio of bonds. The graph showed that the portfolio had a long time horizon. This information was used to make investment decisions about the portfolio.

- Case study 3:An investment goals graph was used to analyze the investment goals of a group of investors. The graph showed that the investors had different investment goals. This information was used to make investment recommendations to the investors.

FAQ Guide: Which Of The Graphs Most Clearly Represents Investors

What factors should be considered when selecting a graph type for representing investor profiles?

The choice of graph type depends on the specific characteristics of the investor data, the objectives of the analysis, and the desired level of detail.

How can data analysis techniques enhance the effectiveness of graphs in representing investor profiles?

Data analysis techniques, such as normalization and outlier identification, help ensure the accuracy and reliability of the data presented in graphs, leading to more informed investment decisions.

What are the key design elements that contribute to the effectiveness of graphs in representing investor profiles?

Essential design elements include color, labels, and annotations, which collectively enhance the clarity, readability, and overall impact of the graphs.