Tracing accounting events to particular companies is a critical aspect of financial reporting, ensuring accuracy and transparency. This comprehensive guide delves into the significance, challenges, and best practices involved in this process, empowering readers to effectively trace accounting events and enhance the reliability of financial statements.

By understanding the intricacies of tracing accounting events, professionals can gain valuable insights into the financial health and performance of specific entities, enabling informed decision-making and fostering trust in the financial reporting process.

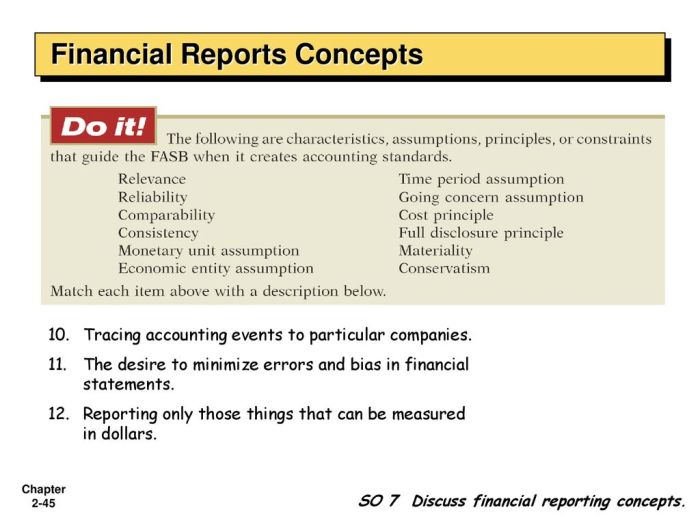

Tracing Accounting Events to Particular Companies

Tracing accounting events to specific companies is essential for accurate financial reporting and decision-making. It ensures that transactions are properly attributed to the entities that incurred them, providing a clear understanding of their financial position and performance.

Challenges and Complexities

Tracing accounting events can be challenging due to factors such as complex business structures, intercompany transactions, and the use of special purpose entities. These complexities can make it difficult to determine which company is responsible for a particular transaction or event.

Impact on Financial Reporting and Decision-Making, Tracing accounting events to particular companies

Accurate tracing of accounting events is crucial for financial reporting. It ensures that financial statements provide a true and fair view of a company’s financial position and performance. Tracing also supports decision-making by providing management and investors with a clear understanding of the company’s financial health and performance.

Methods for Tracing Accounting Events

Document Analysis

Document analysis involves reviewing relevant documents such as contracts, invoices, and bank statements to identify and trace accounting events. This method is commonly used in conjunction with other methods.

Transaction Matching

Transaction matching involves comparing transactions recorded by different companies to identify matches. This method can be effective in identifying intercompany transactions and other related events.

Entity Identification

Entity identification involves determining the legal and economic substance of an entity to ascertain its responsibility for accounting events. This method is particularly important when dealing with complex business structures.

Best Practices for Accurate Tracing

Clear Guidelines and Procedures

Establishing clear guidelines and procedures for tracing accounting events is essential for accuracy. These guidelines should specify the methods to be used, the level of detail required, and the responsibilities of different individuals involved in the process.

Technology and Automation

Utilizing technology and automation can streamline the tracing process and improve accuracy. Software tools can assist in document analysis, transaction matching, and entity identification.

Internal Controls

Implementing internal controls over the tracing process can help ensure accuracy and prevent errors. These controls should include regular reviews and reconciliations, as well as training for personnel involved in the process.

Considerations for Specific Industries

Financial Services

In the financial services industry, tracing accounting events is particularly important due to the complexity of transactions and the need for accurate financial reporting. Challenges include identifying the true ownership of assets and liabilities, as well as tracing intercompany transactions.

Healthcare

In the healthcare industry, tracing accounting events is crucial for understanding the costs and revenues associated with patient care. Challenges include identifying the responsible party for medical expenses, as well as tracing intercompany transactions between hospitals and other healthcare providers.

Manufacturing

In the manufacturing industry, tracing accounting events is important for tracking inventory and production costs. Challenges include identifying the cost of goods sold, as well as tracing intercompany transactions between manufacturing facilities.

Reporting and Disclosure

Reporting Requirements

Financial statements must disclose traced accounting events that are material to the financial position or performance of a company. This disclosure should include the nature of the events, the companies involved, and the financial impact.

Impact on Transparency and Accountability

Accurate tracing and disclosure of accounting events enhance transparency and accountability. It provides investors and other stakeholders with a clear understanding of the company’s financial affairs and supports informed decision-making.

Effective Disclosure Practices

Effective disclosure practices include providing clear and concise information about traced accounting events, using appropriate terminology, and avoiding jargon or technical language that may be difficult to understand.

Top FAQs

Why is tracing accounting events to particular companies important?

Tracing accounting events to specific companies ensures the accuracy and reliability of financial reporting, enabling stakeholders to make informed decisions based on the financial performance of individual entities.

What are the challenges involved in tracing accounting events?

Tracing accounting events can be challenging due to the volume of transactions, the complexity of business structures, and the need for accurate data matching and entity identification.

What best practices can be implemented to ensure accurate tracing?

Best practices include establishing clear guidelines, utilizing technology and automation, implementing internal controls, and conducting regular reconciliations.